Contents:

Vinayak is a passionate financial markets enthusiast with 4+ years of experience. He has curated over 100 articles simplifying complex financial concepts. He has a unique ability to break down financial jargon into digestible chunks. Vinayak aims to empower newbies with relatable, easy-to-understand content. His ultimate goal is to provide content that resonates with their needs and aspirations.

If the P/B ratio is below 1.0, it means that the stock is undervalued. This can be an opportunity for value investors who wish to add undervalued stocks to their portfolio. This also means that in case the company goes bankrupt and liquidates, the shareholders can make a profit on their investment even after the company settles all its liabilities. If the market price of a share goes below its book value per share, one can make a tremendous profit during the company’s liquidation. This metric enables investors to understand whether the stock prices of a particular company are overvalued or undervalued by comparing the book value per share with the market value per share.

The PBV ratio is important as it helps in understanding whether the stock seems reasonable as compared to its balance sheet. The price-to-book ratio (P/B Ratio) is a ratio used to compare a stock’s market value to its book value. Find out how this ratio is calculated and how you can use it to evaluate a stock.

Can Face Value Of Share Be Less Than 1?

Amortization is used to record the declining value of intangible property such as patents. The mark-to-market follow is called fair worth accounting, whereby sure belongings are recorded at their market worth. This signifies that when the market strikes, the value of an asset as reported in the balance sheet may go up or down. The deviation of the mark-to-market accounting from the historic value principle is definitely helpful to report on held-for-sale property.

- Below is the price to book value of refining sector companies.

- Therefore, this value is regarded as a part of the valuation and not the fundamental value or technical value.

- In the data below, you will see a sudden jump in the equity capital of Yes bank in FY’20.

The best example for this is MRF, the company with the highest absolute book value figure among the BSE-500 stocks. Keep in mind the function of book value and market value when making an investment decision. It will help you gauge whether the asset is undervalued, overvalued, or realistically valued. Investments in securities market are subject to market risk, read all the related documents carefully before investing. • It is based on the company’s balance sheet, which is released either quarterly or annually; thus, evaluation of book value may not be relevant at the time of calculation. • If the book value is lesser than the market value, it can be considered as the stock is overvalued and the market has huge growth potential.

It may be that a company has equipment that gets depreciated rapidly, but the book value is overstated. In contrast, a company may have an asset that does not depreciate rapidly, like oil and property, but it has been overlooked and has understated book value. The price-to-book value shows whether a share is undervalued or overvalued. On the other hand, book value per share gives you the value compared with its market value per share. It can reduce liabilities using its profits; resultant, its common equity and book value per share will increase. The modus operandi observed is that once a client pays amount to them, huge profits are shown in his account online inducing more investment.

Open Demat Account &

https://1investing.in/ legends have made their fortune by investing in undervalued stocks. As per the tenets of value investing, any value under 1 is considered a good value. However, investors often consider stocks with a PBV value under 3.

Even if you have found an undervalued stock, it can still result in a loss. It would be best to wait for the market to arrive on the same page as you before planning to book a profit on your findings. So, an investor must always look into the details of the book value before investing in a company. This lack of standardisation is the reason behind that muzzy book value. On the other hand, the company can also use INR 400,000 to reduce its liabilities and increase its common equity. If you want to know how book value per share can analyse such crucial pointers, read on to understand it in detail.

Company Info

The below table shows the price to book value of 30 sensex stocks. Let us quickly look at the price to book value of Sensex stocks. Let us calculate the price to book value ratio for Reliance Industries Ltd. Price to Book Value is also known as Market to Book Ratio or Price to Equity Ratio or simply P/B ratio.

If a book value goes on with a face value of ₹10 and a market price of ₹1000 announces a dividend of 100 percent of the face value, it means a dividend of ₹20 per share. While the face value could be an arbitrary number (which is ₹10 for most stocks), the premium over face value is not at all arbitrary. It depends on the company’s growth potential and profits and sales figures.

P/B ratio acts as a comparison tool while making an investment decision. Book Value per share is calculated using historical costs, and unlike market value per share, it does not reflect the actual market value of the company’s share. Overvaluation of the company’s assets might be another reason its book value is higher than its market price.

5 fundamentally strong stocks trading near 52-week low. Time for bottom fishing? Mint – Mint

5 fundamentally strong stocks trading near 52-week low. Time for bottom fishing? Mint.

Posted: Mon, 27 Mar 2023 06:30:06 GMT [source]

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from the depository on your email id and/or mobile number to create a pledge. Pay 20% upfront margin of the transaction early to trade in the cash market segment. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

This means that along with their obsession with net profit, investors also have to take a closer look at the changes in book value. If these figures do not match, it is certain that the company has hit the balance sheet directly and needs to be investigated further. Market capitalisation is the product between the total number of outstanding shares of an organisation and its current market price.

An important caveat is that the ratio is dependent on the quality of earnings declared which depends to a great extent on the accounting practices used. Savvy investors are always on the lookout for stocks that are not fully valued or, still better, are grossly undervalued. An important measure of value is the book value per share-total assets minus intangible assets and liabilities divided by the number of outstanding shares.

What Is Face Value Of A Share? – Unmask the Accounting Value of a Stock

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in the investor’s account. If you divide it with the outstanding shares , you get the book value per share, which is ₹150. And it has total assets of ₹20 crore and total liabilities worth ₹5 crore.

The face value is the nominal value of the shares, that is, their original cost, as mentioned in the share certificate. It is just an accounting value that could either be ₹ 1, ₹ 2, ₹ 5, ₹ 10, or even ₹ 100. The concept of face value can be easily understood with an example of an initial public offering .

- Only then you can conclude that the stock is truly undervalued.

- I recommend to follow the author on youtube where you can find hours of lessons from him on valuation.

- This ratio provides a valuation check for investors seeking reasonable growth from companies.

- In the stock market, book value per share is a benchmark that investors can use to analyse how a company’s stock is valued.

- The definition is also equally valid for bonds at the bond market.

- And to be eligible for dividends payouts, you must have a demat account and invest in dividend-paying stocks.

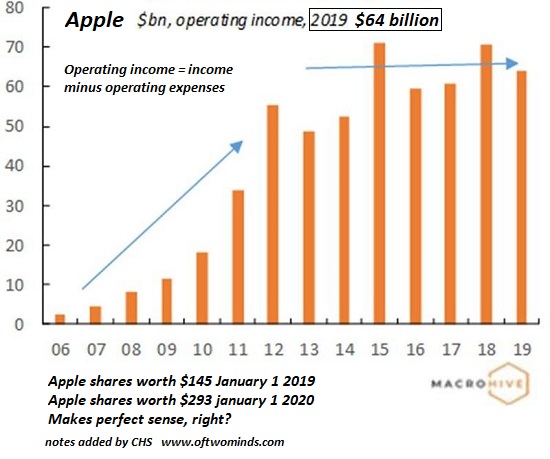

When valuing a company, the PE ratio is most commonly used measure. This is because when we buy shares in a company, we are buying into their future earnings. Earnings is what is left for shareholders once all expenses are paid. The PCF ratio measures how much we are paying for a company’s cash flow.

Book value literally translates into the value of a company’s book or its financial statements. Book value is the worth of a company based on its financial books. Market value is the worth of a company based on the perceived worth by the market. Any organisation reports its Balance Sheet quarterly or annually.