We also evaluate potential explanations for the unprecedented stock market reaction to the COVID-19 pandemic. We find that that approximately 90% of the S&P1500 stocks generate asymmetrically distributed large negative returns (Fig. 1

). When analyzing single-day extreme events, namely Black Monday, Black Thursday, and Black Monday II, we find that firms that operate in crude petroleum sector are hit hardest and lose over 60% of their market values in a day. In contrast, firms in natural gas and chemicals sectors improve their market valuations and earn positive returns of more than 10%, on average. Further, we study industry-level patterns and show that during March 2020 stock market crash the best performing industries include healthcare, food, software and technology, as well as natural gas. The superior performers in these industries yield a positive monthly return of over 20%.

Democratic Rep. Earl Blumenauer of Oregon reported that his wife, Margaret Kirkpatrick, bought up to $15,000 worth of stock in Quest Diagnostics, a leading COVID-19 test provider, in March 2020. Blumenauer did not respond to repeated requests for comment about his financial filings. https://topforexnews.org/software-development/top-5-places-to-find-a-wordpress-developer/ In this section, we focus on the safe haven property during extreme movements of the health crisis. Where rh,t is the hedged portfolio return; rj,t is the Bitcoin (or gold) return; ri,t is the stock index (or currency) return; and βi,t is the optimal hedge ratio calculated from Eq.

Table 6

After dropping steadily through the autumn, it began rising again in late November. In 2020, at least 13 senators and 35 US representatives held shares of Johnson & Johnson, the medical behemoth that produced the single-shot COVID-19 vaccine that https://forex-world.net/brokers/kab-definition-and-meaning/ more than 15 million Americans have received. 4Nevertheless, on May 12, 2021, Tesla stopped accepting Bitcoin as a payment method for its products. As a result, Bitcoin price plunged from a nearly $58,000 to below $38,000 in just 10 days.

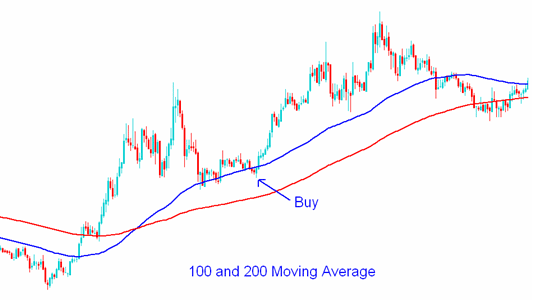

China Stocks: Three Are In Buy Zones Now – Investor’s Business Daily

China Stocks: Three Are In Buy Zones Now.

Posted: Fri, 14 Jul 2023 22:01:00 GMT [source]

Motivated by these observations, we examine the role of COVID-19 developments in recent stock market behavior and draw comparisons to previous infectious disease outbreaks. Among survey respondents, all automotive and nearly all (97%) industrial products companies said the pandemic has had a negative effect on them. In addition, 47% of all companies reported the pandemic disrupted their workforce. While many employees were asked to work from home, others — especially in factory settings — had to adapt to new requirements for physical spacing, contact-tracing and more personal protective equipment (PPE). Industrial products and high-tech manufacturing companies are investing overwhelmingly in technology to reduce employee exposure to COVID-19 in more labor-intensive industries.

2. March 2020 stock market crash and industry-level performance

Often in uncertain economic environments, companies slow their technology investments to a trickle. This speaks to the value of a digital supply chain in helping enterprises navigate disruptive forces and respond faster to volatile supply and demand. In the aftermath of severe disruption from the COVID-19 pandemic, the survey found that enterprises plan to shake up their supply chain strategies to become more resilient, sustainable, and collaborative with customers, suppliers, and other stakeholders.

As the U.S. economy begins to recover and reopen, many consumers are still scrambling to regain their financial footing. While the conventional wisdom is to sock away six to 12 months worth of savings, that became an impossibility for many during the COVID-19 pandemic, as millions of people lost their jobs, small businesses were forced to shutter, and day-to-day living expenses piled up. Financial assistance from the Economic Injury Disaster Loan (EIDL) was requested by 6.6 percent of companies without employees and received by 4.7 percent during the Coronavirus pandemic in 2020. Financial assistance from the Paycheck Protection Program (PPP) was requested by 10.5 percent of companies without employees and received by 8.4 percent during the Coronavirus pandemic in 2020.

Vietnam’s big bet on LNG may not ease its power crisis

While other periods have seen large declines or increases in equity markets over periods of several weeks or months, the COVID-19 period stands out for an extremely high frequency of large daily stock market moves. Future research could implement the Value-at-Risk (VaR) analysis in a time rolling-window manner to detect and manage market risks over different time horizons, and investigate portfolio profit & loss (P&L) dynamics. The curious researcher could expand the analysis to include other digital assets to examine their diversification potential and to find out if they can outperform Bitcoin and gold and can offer better hedge.

- For example, Gulfport Energy displays the widest daily amplitude of price movement of roughly 130%.

- Regeneron has been a model among pharmaceutical companies and biotech stocks, boasting average annual revenue growth of nearly 22% over the past five years.

- Some of it comes down to planning, yet only about one-third of Americans actually have a financial plan in writing.

- Novavax (NVAX, $43.63) surged in late February after the company updated its progress on developing a coronavirus vaccine.

Here are 10 health and pharmaceutical companies playing a role in the fight to control the COVID-19 coronavirus, including several updates to reflect some treatments’ progress. Each of these stocks has the potential for considerable gain, whether it’s because they’re developing a treatment or their products are in greater need amid the outbreak. To date, each stock has outperformed the S&P 500 since the bear market began in mid-February, with many posting healthy to downright gaudy gains. Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine’s investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the “Your Mind and Your Money” column, a take on behavioral finance and how investors can get out of their own way. Smith is a graduate of St. John’s College in Annapolis, Md., the third-oldest college in America.

How COVID-19 impacted supply chains and what comes next

Throughout its history, gold has been viewed as a value store, portfolio stabilizer and source of liquidity in times of financial turbulence. Gold is known as a hedge against inflationary pressures in the U.S. and U.K. It reacts counter-cyclically to macroeconomic news (Elder, Miao, & Ramchander, 2012) and works differently from other assets, especially stocks. Its effectiveness as a hedge and safe haven against equities in different markets is well confirmed by numerous studies (e.g., Baur & Lucey, 2010; Beckmann, Berger, & Czudaj, 2015, among others). The COVID-19 pandemic has succeeded in looting and destabilizing the entire world.

The panic attacks are not properly defined without linkage to anxiety disorder in the medical sense. Anxiety is a combination of different psychiatric disorders both internal (phobias, panic attacks, and panic disorder) and external (worry, stress, fear, painful experiences, or events). The psychological effect of COVID-19’ has led to mass hysteria, post-traumatic stress disorder (PTSD), panic attacks, obsessive-compulsive disorder (OCD), and generalized anxiety disorder (GAD). The behavioral immune https://currency-trading.org/software-development/rfp-template-for-software-procurement/ system (BIS) theory, stress theory, and perceived risk theory explain that negative emotion (anxiety, aversion) and negative cognitive assessment of human beings are developed for self-protection. People tend to develop avoidant behavior and strictly follow the social norms due to the pandemic’s severe effects and the potential threat of disease (Cao et al., 2020; Lai et al., 2020; Sarfraz et al., 2020b). The anxiety, stress, and panic attacks of people due to COVID-19 have created two etiologies.

Should you save or invest during the pandemic? Ask yourself these 4 questions

Though some new drugs are off to a good start and selling well, that’s been offset by slowing sales for its older treatments, which are under pressure from competitors. And while management expects adjusted earnings and revenue to decline on a year-over-year basis in fiscal 2023 due to forex headwinds and lower sales of its COVID-10 treatment Lagevrio, Merck’s financial strength remains sound, Hellweg says. Companies will continue to invest in software and hardware solutions to high labor costs, he says, and many of the firms have “fantastic” balance sheets.

An example is responding to a change in customer demand, seen instantly by the entire value chain (the organizations, its suppliers and their suppliers’ suppliers) so they can collectively adjust supply plans and production schedules immediately. Ultimately digital and autonomous technologies will help make people’s jobs easier and the supply chain more efficient and optimized. The correlation matrix results are displayed in Table 6, which is employed to check the multicollinearity among independent variables. The range of correlation matrix for the Nikkei 225 stock market is between −0.0991 and 0.8008, which rejects the existence of multicollinearity. Relationship between Nikkei 225 market returns and created Sentiment Index.

As more Americans get vaccinated and infection rates ease, the U.S. economy is slowly reemerging. Businesses are reopening, hiring is on the rise, and that eventually should ease some of the financial strain felt by many. Finally, innovate with customers in mind through a truly sustainable supply chain — one that is designed with circularity and the environment in mind.

- “In the very short term, I think we are a little bit over bought here,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab.

- Consequently, this leads to the sharp reduction in consumption and economic output, lowering the stream of expected future cash flows.

- Looking forward, multiple disruptions are happening more quickly and factors such as geopolitical risks, cyber threats and economic instability are continuing to put pressure on supply chains.

- This explains that when the feeling of fear increases in the U.S. market, investors turn to other assets such as cryptocurrencies.

- If claims about the company’s products are inaccurate or unreliable, you may lose a lot of the money you invest.